|

|

|

Cindy (age 40, optimum non-smoker) is a partner and doctor in a family practice who earns $250,000 annually. She has recently decided to move from the suburbs to downtown living and is looking to protect her total financial obligations of $1,750,000 for the next 30 years. She wants to cross life insurance off her to do list and not have to think about it for a while, and guarantee her premiums for as long as she needs the protection.

What is the best way to protect Cindy?

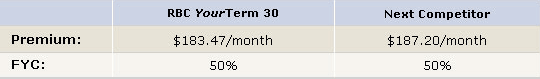

Cindy’s advisor recommends an RBC YourTerm™ 30 policy for $1,750,000 due to its flexible term lengths, and guaranteed market leading premiums.

Cindy can now cross life insurance off her to do list knowing her current financial obligations will be taken care of and contact her advisor as her needs change in the future.

Top 5 reasons to choose RBC YourTerm Life Insurance for your clients

- Full selection of term lengths from 10 to 40 years, and anything in between.

- Competitive Premiums and FYC.

- Coverage is considered fully paid on the anniversary nearest the insured’s 100th birthday, and coverage continues until death.

- Exchange an RBC YourTerm 10 within the first 5 years to a RBC YourTerm 15, 20, or 30 with no medical exam.

- Convertible to a permanent coverage policy.

|

|

|

|